He has built multiple online businesses and helps startups and enterprises scale their content marketing operations. He worked with TIME, Observer, HuffPost, Adobe, Webflow, Envato, InVision, and BigCommerce. Moreover, if you have inaccurate information, you might inadvertently mislead your lenders, creditors and investors, which can have serious legal consequences. Finally, if your books are disorganized, you might provide inaccurate information when filing taxes. Recording documents essential information from the transaction, such as the transaction date, amount, customer name, and other information the business needs. It also leaves a clearer paper trail, which is essential for audits.

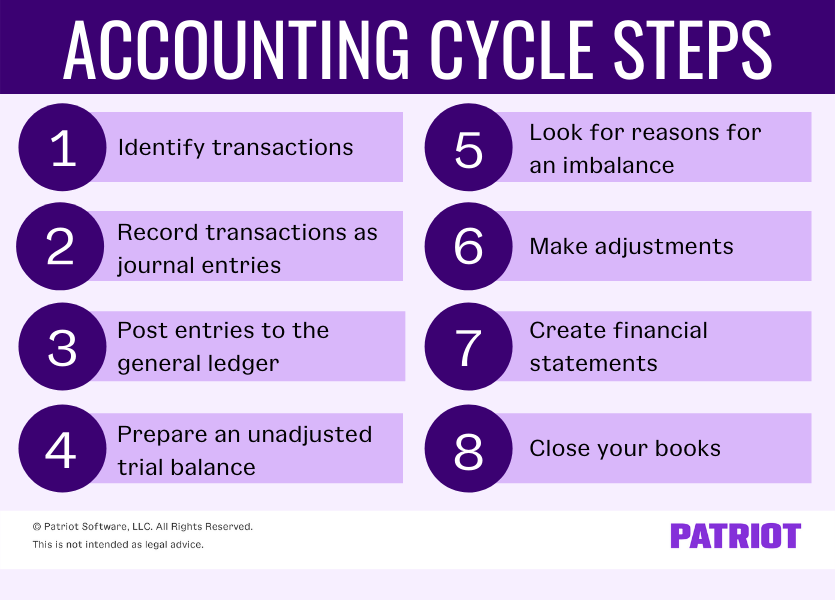

Close the books for the accounting period.

It doesn’t require multiple entries but instead gives a balance report. When a transaction is recorded, it has to be posted to an account on the general ledger. Accounts have to do with business operations, as well as where money is moving. The general ledger allows bookkeepers to monitor a company’s financial position. General ledger accounts are often referenced on financial statements. One of the most common to be referenced is the cash account, which tells a business how much cash is available at any time.

Financial Statements

- It serves as a clear guideline for completing bookkeeping tasks accurately.

- Learn more about our full process and see who our partners are here.

- Once you’ve made the necessary correcting entries, it’s time to make adjusting entries.

- The accounting cycle is important because it gives companies a set of well-planned steps to organize the bookkeeping process to avoid falling into the pitfalls of poor accounting practices.

This can provide businesses with a clear understanding of their financial health and ensure compliance with federal regulations. During the accounting cycle, many transactions occur and are recorded. At the end of the fiscal year, financial statements are prepared (and are often required by government regulation). The main difference between the accounting cycle and the budget cycle is that the accounting cycle compiles and evaluates transactions after they have occurred. The budget cycle is an estimation of revenue and expenses over a specified period of time in the future and has not yet occurred. A budget cycle can use past accounting statements to help forecast revenues and expenses.

Step 4: Unadjusted Trial Balance

These are not the only financial statements that can be generated, but they are the most important. When a company moves through all of the steps of the accounting cycle, these statements are the results. If they are viewed together, they can paint a picture of the company’s financial health. This period of time is often referred to as the accounting period.

This step generally identifies anomalies, such as payments you may have thought were collected and invoices you thought were cleared but weren’t. The trial balance gives you an idea of each account’s unadjusted balance. Such balances are then carried forward to the next step for testing and analysis. The next step is to record your financial transactions as journal entries in your accounting software or ledger.

Ensures financial statement accuracy and compliance

The unadjusted trial balance is then carried forward to the fifth step for testing and analysis. With double-entry accounting, common in business-to-business transactions, each transaction has a debit and a credit equal to each other. It gives a report of balances but does not require multiple entries.

Ray’s accounting system creates journal entries for his bank and credit card transactions automatically. An example of identifying transactions would start with point-of-sale software. Many of these software options automatically identify a transaction. Accounting is made up of all of the ways that a business’s money moves. It documents every transaction, making sure that things are accurate and kept track of.

Therefore, their accounting cycles are tied to reporting requirement dates. The first step in careers at xero is identifying transactions. Companies will have many transactions throughout the accounting cycle. The accounting cycle is a series of eight steps that a business uses to identify, analyze, and record transactions and the company’s accounting procedures. As a small business owner, it’s essential to have a clear picture of your company’s financial health. Once you’ve posted all of your adjusting entries, it’s time to create another trial balance, this time taking into account all of the adjusting entries you’ve made.